The Johor–Singapore Special Economic Zone (JS-SEZ) is one of the most transformative economic initiatives in Southeast Asia, aiming to strengthen the economic ties between Johor in Malaysia and neighboring Singapore. This SEZ is not only an ambitious cross-border collaboration to boost trade, investments, and job creation but also a game-changer for the property market in Johor and potentially in Singapore. For property buyers and investors, understanding the nuances of the JS-SEZ, its implications for real estate, and the long-term growth prospects is critical. This comprehensive blog explores the JS-SEZ in depth and explains what it means for property buyers and investors.

Table of Contents

What is the Johor–Singapore Special Economic Zone (JS-SEZ)?

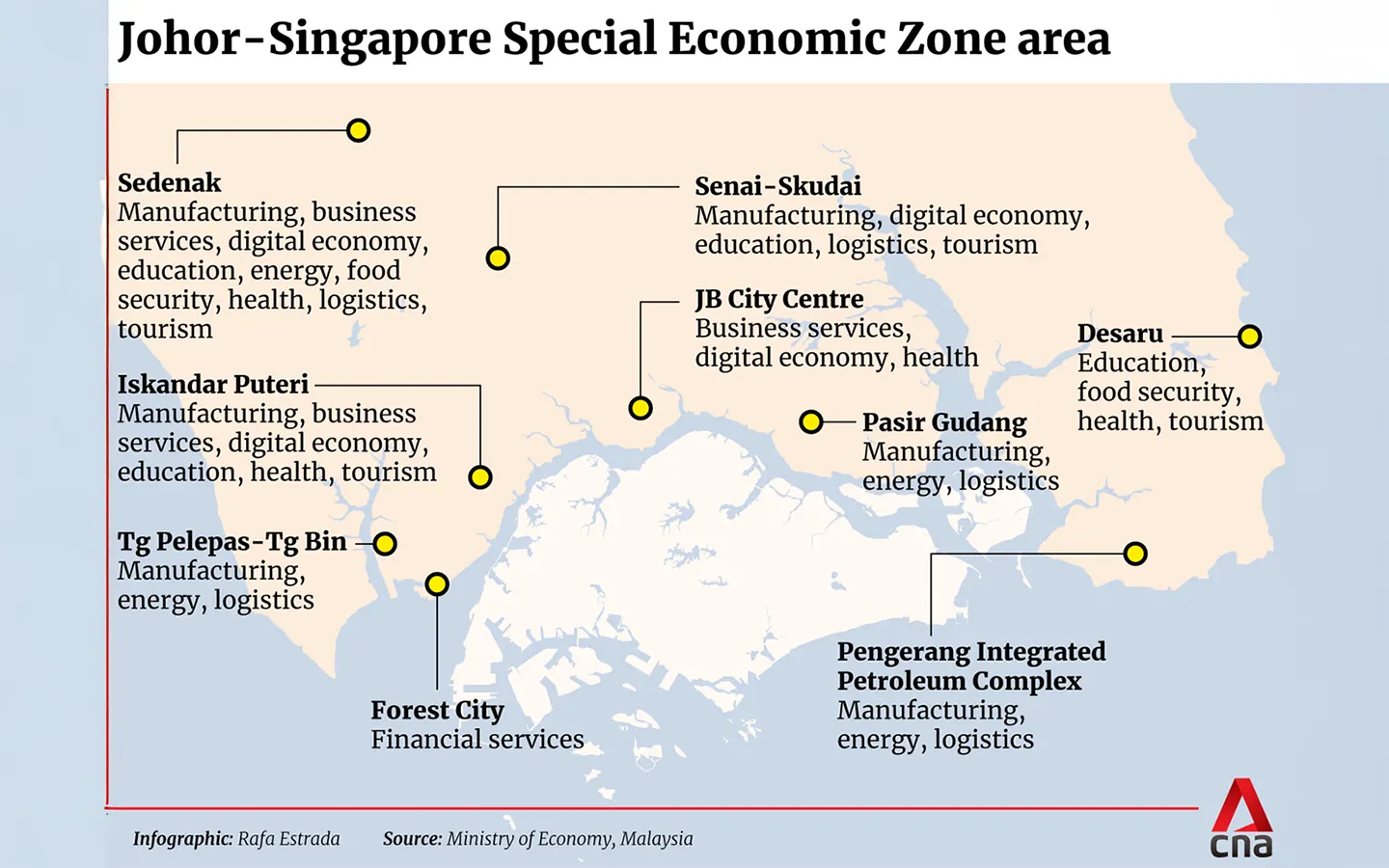

The JS-SEZ is a strategic partnership between Malaysia and Singapore designed to foster economic cooperation and regional development. It covers over 3,500 square kilometers across nine flagship zones in Johor, including industrial parks, logistics hubs, and energy clusters. The main goals of the SEZ are to attract global investments, create skilled jobs, and build an integrated economic ecosystem leveraging the strengths of both regions.

Key industries targeted under the SEZ include manufacturing (especially semiconductor and pharmaceutical sectors), logistics, digital economy, and energy. Parallel to this, there is a focus on growing the MICE (Meetings, Incentives, Conferences, and Exhibitions) industry with Johor’s capacity to host larger-scale events than Singapore due to availability of ample land and more affordable pricing.

Infrastructure Developments Boosting the SEZ

Critical infrastructure investments are underpinning the development of the JS-SEZ. Foremost among them is the Johor Bahru-Singapore Rapid Transit System (RTS) Link, which will connect Woodlands North MRT station in Singapore to Bukit Chagar station in Johor Bahru. This four-kilometer rail link will drastically reduce cross-border commutes to just six minutes and is expected to be operational by the end of 2026.

The RTS will greatly enhance accessibility for workers, tourists, and business travelers, supporting seamless integration of the two economies and boosting property demand in the border region. Improved infrastructure also includes ongoing road enhancements and proposed ferry services that aim to ease traffic congestion and expand connectivity options.

Impact on Johor’s Property Market

The JS-SEZ has already sparked a surge in Johor’s property market, particularly in Johor Bahru. Residential property prices have seen notable growth, fueled by strong investor confidence and rising demand for high-end and mid-range properties. In the second quarter of 2025 alone, serviced apartments experienced a price increase of over 20%, while double-storey terrace houses grew by nearly 9%.

This price appreciation is buoyed by local and regional buyers who are attracted by Johor’s cost-effective lifestyle, improving infrastructure, and proximity to Singapore’s thriving economy. The SEZ’s creation of approximately 20,000 skilled jobs within five years is expected to drive sustained demand for residential properties, especially in strategically located areas close to SEZ developments.

Real Estate Investment Opportunities in the SEZ

Investors are focusing on several important property segments within the SEZ:

- Residential Properties: There is robust demand for residential homes from workers relocating to Johor for jobs created by the SEZ and from Singaporeans seeking second homes or more affordable living options outside Singapore. Opportunities exist in both purchase and rental markets, with build-to-rent developments gaining interest to cater to short-term and mid-term tenants.

- Industrial and Logistics Real Estate: Given Johor’s positioning as a manufacturing and logistics hub, especially in semiconductor and pharmaceutical sectors, industrial spaces and logistics warehouses are highly sought after. These sectors benefit from Johor’s lower operation costs while maintaining proximity to Singapore’s market.

- Commercial and Office Space: The SEZ is attracting regional headquarters and high-value businesses that require office space, creating demand for commercial real estate in Johor and nearby areas.

- Hospitality and MICE Venues: With projections that overnight visitors to Johor could double from 4 million in 2024 to 8 million by 2030, hotel developments, especially in mid-range and upscale segments, have strong growth potential. Johor’s ability to host large conferences and exhibitions also presents investment opportunities in this niche.

What It Means for Property Buyers

For property buyers, the JS-SEZ represents an opportunity to invest early in a growing economic region with strong fundamentals. Buyers can expect:

- Capital Appreciation: Early-stage investments in residential or commercial properties in the SEZ zones are likely to experience significant capital appreciation as infrastructure projects complete and economic activity intensifies.

- Rental Demand: The influx of workers and expatriates seeking housing means solid rental yields, especially in areas around the RTS stations and other transport links.

- Diversified Options: Buyers can choose from affordable homes to luxury residences, depending on their budget and investment goals, in a market with a favourable cost-to-value ratio compared with Singapore.

- Cross-Border Advantage: Proximity to Singapore combined with Johor’s lower land and labor costs makes buying property here attractive for those seeking regional diversification or to capitalize on economic integration.

What It Means for Property Investors

For property investors, the JS-SEZ is a catalyst for long-term growth and diversification:

- Strong Demand Drivers: The SEZ’s job creation and industrial growth underpin ongoing demand for all property types — residential, industrial, commercial, and hospitality.

- Positive Price Trends: Data shows price rises of 8-20% in residential segments in early 2025, signaling investor confidence and upward momentum.

- Infrastructure Catalyst: Transit projects like the RTS will significantly enhance connectivity, making Johor properties more accessible and desirable, raising property values and rental demand.

- Emerging Sectors: Investors can tap into growing sectors such as digital economy, biomedical, and advanced manufacturing by focusing on strategic SEZ zones.

- MICE Industry Growth: The development of meeting and exhibition spaces could diversify real estate income sources beyond traditional residential and industrial assets.

Challenges and Considerations

While the JS-SEZ offers many opportunities, buyers and investors should consider:

Long-Term Vision: Gains may accrue over a medium to long-term horizon as infrastructure completes and economic integration deepens.

Market Maturity: Johor’s property market is still developing, with some oversupplies in high-end residential properties; careful selection of location and property type is critical.

Affordability and Demand: For sustainable growth, affordability for workers and tenants must be balanced with investor expectations; pricing should remain accessible for the expanding workforce.

Regulatory and Cross-Border Factors: Buyers should stay informed of legal, taxation, and cross-border commuting policy developments that may affect property ownership and rental operations.

Conclusion

The Johor–Singapore Special Economic Zone is a landmark initiative poised to reshape the regional economy and real estate landscape. For property buyers and investors, it offers a wealth of opportunities fueled by strategic infrastructure, government backing, and strong economic fundamentals creating significant demand across residential, industrial, commercial, and hospitality sectors. Early investments in carefully chosen areas within the SEZ could yield substantial capital appreciation and rental returns in the years ahead.

Whether seeking to buy a home, invest in rental properties, or capitalize on industrial and commercial growth, understanding the JS-SEZ’s vision and momentum is essential to making informed decisions and benefiting from this growing regional powerhouse. The synergy between Singapore’s global market access and Johor’s cost-effective environment creates a compelling case for investing today in what promises to be a vibrant and dynamic property market tomorrow.

For more insights and updates on Johor properties and investments, stay tuned for future blogs covering specific SEZ zones, transit-oriented development hotspots, and sector-focused investment guides.

resources:

- https://www.bernama.com/en/news.php?id=2446264

- https://www.businesstimes.com.sg/property/real-estate-investors-eye-residential-and-industrial-development-sites-johor-singapore-sez

- https://www.reedsmith.com/en/perspectives/2025/07/investing-in-the-johor-singapore-special-economic-zone-a-mid-2025-recap

Share this articles:

Join The Discussion